Reliance Shares Plunge 4.5% Amid Retail Woes and Russian Oil Uncertainty

Image Source: Internet

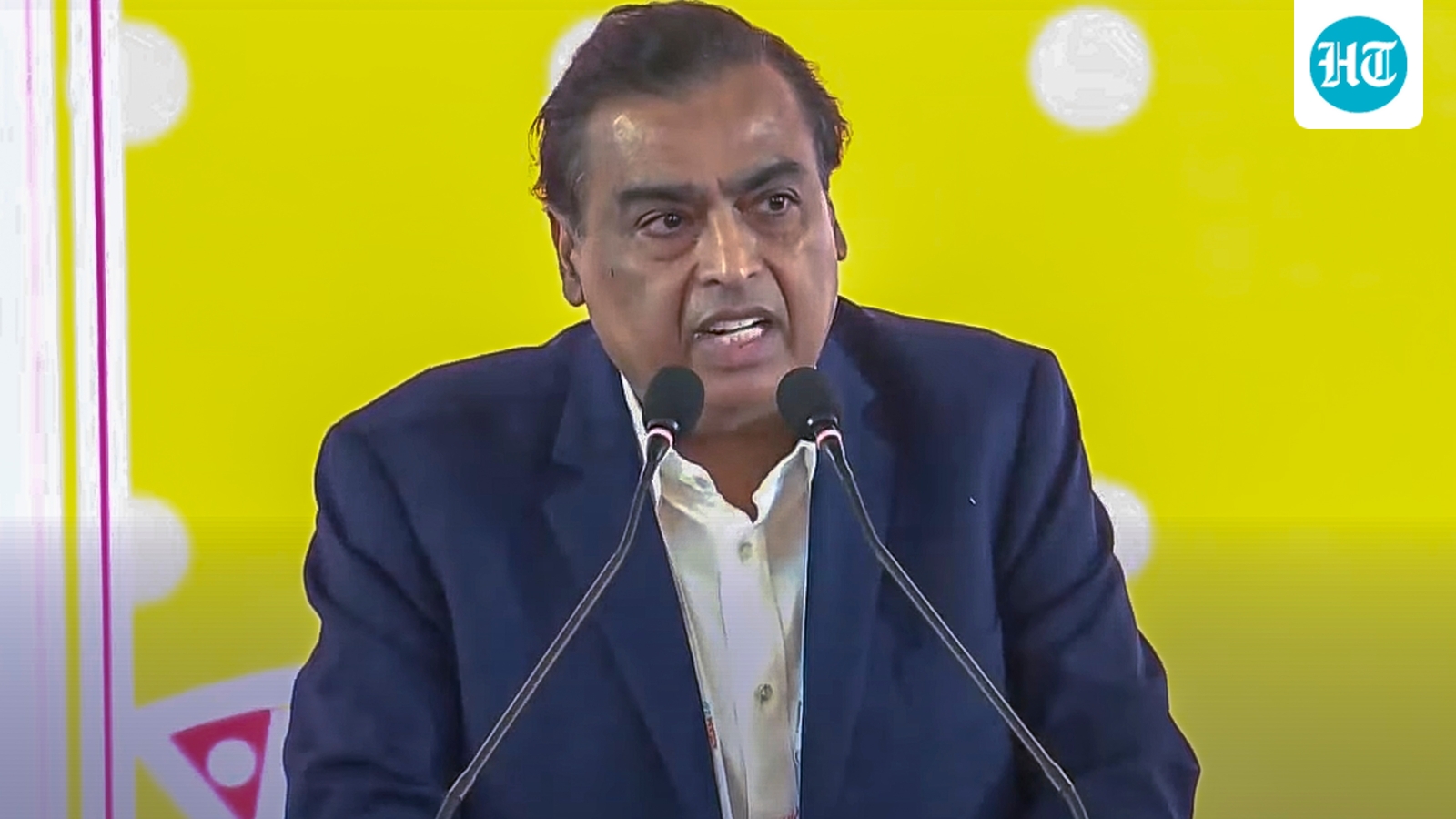

Reliance Industries, led by billionaire Mukesh Ambani, witnessed a sharp decline in its stock price on Tuesday, wiping out over $10 billion in market capitalisation. The company's shares fell 4.5% as investors grew anxious about the retail sector's health and uncertainty surrounding its crude oil sourcing. Investors were spooked by the retail sector's struggles, with fast-fashion retailer Trent Ltd reporting a 15% year-on-year drop in average revenue per square foot in the December quarter. This pointed to a tougher operating environment, with Citigroup commenting that intensifying competition was eroding the market share of incumbents, affecting Reliance's retail business. Reliance Retail is a crucial driver of the group's valuation, with ICICI Securities valuing the retail business at over $103 billion in October. Although the retail arm is closely held, weak commentary around peers was viewed by investors as a broader sector risk that could hurt India's largest retailer. Additionally, concerns over Reliance's oil supply have been mounting. The company, which operates the world's largest single site oil refining complex, has not received any Russian barrels in almost three weeks and none are expected in January. This is in compliance with European Union sanctions, which Reliance had begun to adhere to in November. The selloff was compounded by profit booking, with Reliance shares having surged about 29% in 2025. However, experts remain optimistic about the company's growth prospects in 2026, citing potential catalysts such as an initial public offering of Jio Platforms, increases in telecom tariffs, and further upside to refining margins. Analysts, however, caution that uncertainties around potential US tariffs on India, patchy recovery in consumer demand, and elevated valuations could continue to cap gains. The weakness in Reliance also weighed on other energy stocks, with state-run refiners Bharat Petroleum Corp and Hindustan Petroleum Corp slipping about 2% each.